Tax Rebate 2025 Singapore Foremost Notable Preeminent. Personal income tax rebate for year of assessment 2025. Increase in personal income tax rebate for ya 2025:

The government will also provide a personal income tax rebate of 60 per cent, for the year of assessment 2025. As part of the sg60 package to share the gains of our nation’s progress, a personal income tax rebate will be granted to all tax resident. Benefits are subject to the individual’s or household’s eligibility.

Source: www.businesstimes.com.sg

Source: www.businesstimes.com.sg

Budget 2025 Tax rebates to draw companies to Singapore The Business A personal income tax (pit) rebate of 60% of tax payable will be granted to all tax resident individuals for ya 2025, capped at $200 sgd per taxpayer. Benefits are subject to the individual’s or household’s eligibility.

Source: about.sg

Source: about.sg

Singapore Homeowners to Benefit from OneOff Property Tax Rebates in Benefits are subject to the individual’s or household’s eligibility. A personal income tax (pit) rebate of 60% of tax payable will be granted to all tax resident individuals for ya 2025, capped at $200 sgd per taxpayer.

Source: gpsjandiala.com

Source: gpsjandiala.com

Singapore Budget 2025 Key Benefits, Tax Changes, and Infrastructure Plans The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024). Personal income tax rebate for year of assessment 2025.

Source: counto.sg

Source: counto.sg

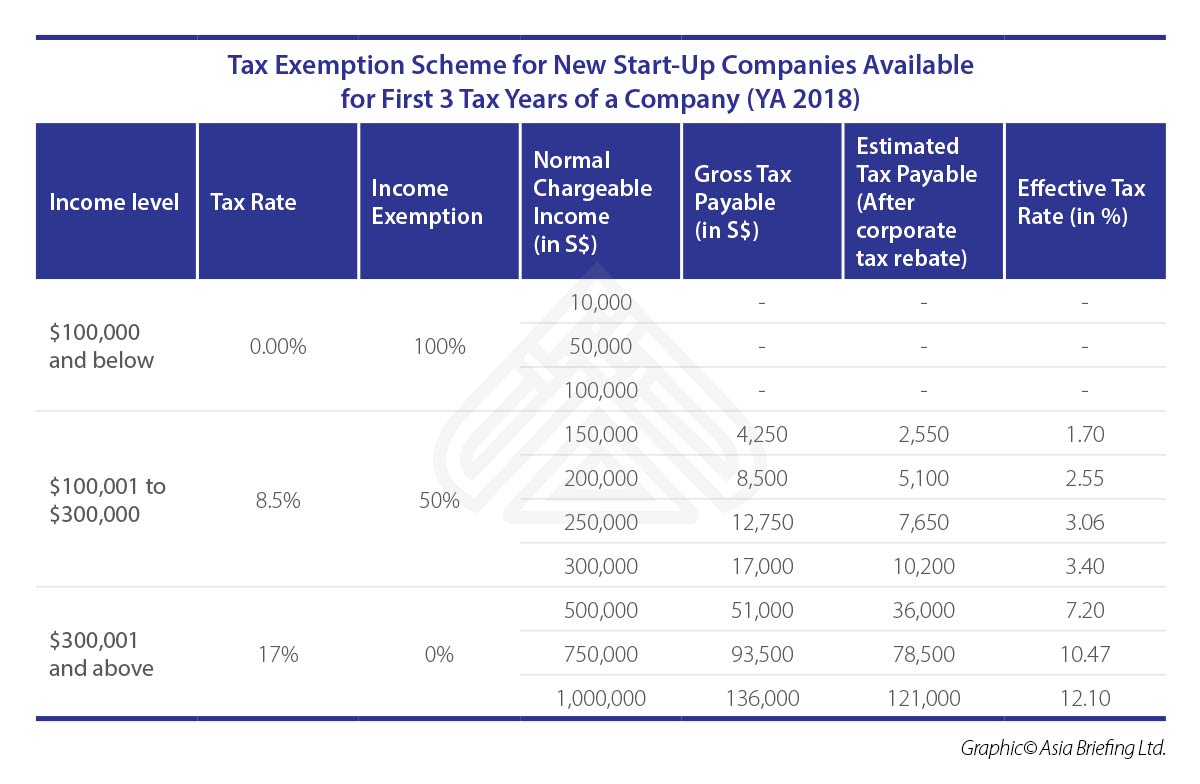

Singapore's 2025 Corporate Tax Rebates 50 Rebate & 2,000 Cash Grant Increase in personal income tax rebate for ya 2025: A personal income tax (pit) rebate of 60% of tax payable will be granted to all tax resident individuals for ya 2025, capped at $200 sgd per taxpayer.

Source: telegra.ph

Source: telegra.ph

Singapore tax Telegraph The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024). View the measures announced at budget 2025 and find out the estimated benefits for you and your household.

Source: ramibelle.pages.dev

Source: ramibelle.pages.dev

Budget 2025 Singapore Corporate Tax Rami Belle View the measures announced at budget 2025 and find out the estimated benefits for you and your household. The government will also provide a personal income tax rebate of 60 per cent, for the year of assessment 2025.

Source: maryquinn.pages.dev

Source: maryquinn.pages.dev

Personal Tax 2025 Mary Quinn Personal income tax rebate for year of assessment 2025. Benefits are subject to the individual’s or household’s eligibility.

Source: felixkanes.pages.dev

Source: felixkanes.pages.dev

Tax Deadline 2025 Singapore Felix Kanes As part of the sg60 package to share the gains of our nation’s progress, a personal income tax rebate will be granted to all tax resident. Personal income tax rebate for year of assessment 2025.

Source: www.pwc.com

Source: www.pwc.com

Personal tax rebate PwC Singapore As part of the sg60 package to share the gains of our nation’s progress, a personal income tax rebate will be granted to all tax resident. The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024).

Source: mothership.sg

Source: mothership.sg

Budget 2025 60 personal tax rebate, capped at S200 per Increase in personal income tax rebate for ya 2025: As part of the sg60 package to share the gains of our nation’s progress, a personal income tax rebate will be granted to all tax resident.

Source: aurapartners.com.sg

Source: aurapartners.com.sg

Tax Return filing Increase in personal income tax rebate for ya 2025: The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024).

Source: providend.com

Source: providend.com

Tax Rebate Singapore Providend The government will provide a personal income tax (pit) rebate of 60% of tax payable for all tax resident individuals for the year of assessment (ya) 2025 (i.e., for income earned in 2024). As part of the sg60 package to share the gains of our nation’s progress, a personal income tax rebate will be granted to all tax resident.